On Wednesday 24th June 2020, Olympus announced that it had signed a memorandum of understanding (MOU) with Japan Industrial Partners, Inc. (JIP) to begin the process of divestiture of its Imaging Business division. In simple terms, Olympus wants to sell its camera department.

Rumours about this have been circulating for the past year, and now many users are worried about the future of Olympus and its micro four thirds products. Are the Pen and OM-Ds’ days numbered, or can the legacy of the brand survive and the development of its products continue?

It is too early to tell for sure, but we can try to analyse the information that has been released so far.

What is a divestiture?

In the statement published on the Olympus Global website, the title reads:

Signing of Memorandum of Understanding for Divestiture of Imaging Business.

Divestiture means the act of selling part of a business unit or an entire business unit. A company can decide to do so to cut costs, reduce debt, reinvest or restructure to make the business more efficient and ideally increase the shareholder value, amongst other things. (Read more about divestiture on Investopedia)

Who is Japan Industrial Partners, Inc.?

Japan Industrial Partners is an investment fund specialised in acquisitions and restructuring of Japanese companies.

According to the Olympus UK Facebook statement:

JIP has a track record of success and has maximised the growth of many brands. JIP will use the innovative technologies and solid brand position of Olympus within the market, while also improving the profit structure of Olympus’s imaging business.

In the statement, Olympus mentions a new company (code name “NewCo”) to whom it would hand over its imaging division. Further down, they explain that:

Olympus’s Imaging business will be transferred to the NewCo by way of company split or otherwise, and then, shares in the NewCo will be transferred to a new company to be established by JIP.

Obviously I am no expert when it comes to businesses and divestiture, but in my understanding JIP would act as an intermediary and manage the transaction until a final buyer is found.

Why does Olympus want to divest?

In its statement, the company explains its motivations clearly. Here is the paragraph extracted from the official letter:

Olympus has implemented measures to cope with the extremely severe digital camera market, due to, amongst others, rapid market shrink caused by the evolution of smartphones; Olympus has improved the cost structure by restructuring the manufacturing bases and focusing on high-value-added interchangeable lenses, aiming to rectify the earning structure to those that may continue generating profit even as sales dwindles. Despite all such efforts, Olympus’s Imaging business recorded operating losses for 3 consecutive fiscal years up to the term ended in March 2020.

A shrinking market, the smartphone evolution (something that is stopping more and more people from buying proper cameras), and financial loss. These are understandable reasons, and I can’t say I’m really surprised.

The latest market sales published by analytics companies and the camera brands themselves have rarely been positive in the last years (with the exception of Sony and Canon a few times). The Covid-19 pandemic hasn’t helped either. When a division continues to lose money year after year, it makes sense for the company to take drastic measures to stop the bleeding.

In the same statement, Olympus writes that they intend to close the transaction with JIP by the end of the year, which gives them about six months to decide on the future of the Imaging Division.

Is this the end of Olympus cameras?

Don’t answer “yes” just yet!

The second point in the Olympus official statement, that many seems to have missed, is that the goal of this manoeuvre is to keep the imaging products alive. Precisely, they say:

NewCo will succeed and maintain the research and development functions and manufacturing functions globally as reformed under the contemplated structuring reforms to continue to offer high-quality, highly reliable products; and also continue to provide supports to the imaging solution products that have been distributed by Olympus.

If we trust these words, it would seem that the will of the company is for its imaging business to survive, despite being carried out by somebody else.

In the most positive scenario, Olympus and JIP will find an agreement with a third company to keep the name alive and hopefully continue the development of micro four thirds products, as well as ensure customer support. Olympus has worked really hard on creating a niche of faithful users by building a more portable alternative for wildlife photography amongst other genres. It would be a shame to see that disappear.

Of course this initial statement highlights the plan and its objective, which doesn’t sound totally negative, but if we want to play the devil’s advocate, we can certainly raise some questions.

To me the biggest one is: who would be willing to buy Olympus’ Imaging Division? The ideal candidate would be Panasonic, who in addition to having co-developed the micro four thirds system with Olympus, is a big corporation with hopefully enough resources to make such a move.

At the same time, what could Panasonic do with Olympus products? They are already selling their own, so it is most likely they would be interested in buying some of the technology (phase detection sensors maybe?) rather than continuing the OM-D and Pen series. Perhaps they could provide support for existing customers. But of course, it all depends on what Panasonic’s plans are. It doesn’t look like the Lumix series is doing great sales-wise (except for the GH models), and the full frame S series is most certainly doing worse.

Another camera company is unlikely unless they just want to buy the technology and know-how. Sony would be the most likely candidate because of its resources, but they already have two camera systems to deal with. Gaining access to Olympus’ tech such as the best image stabilisation on the market could be interesting, but at the same time it’s something they already have (albeit with inferior performance).

Another option is a third party company that is willing to invest in a niche of a shrinking market, and has the financial resources to sustain product development and support.

As for the worst case scenario, it would be that JIP is unable to find a buyer. They would then help Olympus keep the Imaging Division alive with a large restructuring, maybe sell their technology to third parties or eventually close it if it can’t be saved.

It’s hard to tell which way things will go for now, but it is certainly going to have an impact on all the people employed by the company. Divestiture means restructuring and streamlining, cutting costs and sadly, as a consequence, cutting jobs.

My hope is that Olympus will succeed in saving its legacy. 84 years have passed since the first camera was released on the market and I’m confident that is not something they are willing to lose so quickly.

What will the future of Micro Four Thirds be like?

The phrase “Micro Four Thirds is dead” has been seen many times before. Perhaps the aim of some bloggers or Youtubers was to gain visits more than anything else, but behind the clickbait titles there were some legitimate questions.

To me the biggest indication that something was not right was Olympus’ 100th anniversary last year. Such a milestone for a company would usually be met with special launches, events and a campaign that would go on all year to mark this outstanding milestone. Instead we got very little, both in terms of events and products. If there was more going on, then the communication was scarce.

If somehow the Olympus brand and products can survive, the micro four thirds system might be fine. However, if Olympus cameras disappear, I do wonder what the future of the system will be.

The strength of micro four thirds has always been Olympus + Panasonic sharing the same mount and creating a versatile system with plenty of choice for customers. If one of them is gone, can the other survive? And will it have the inclination to continue?

Surely Panasonic has a rich catalogue, but its strength has always been the GH series and its high-end video features. Other products have struggled to obtain the success they deserve. The company has also ventured into the full frame market with the S line but so far with little success as far as I know.

Panasonic looks much bigger in my eyes as a corporation, because it has its fingers in many departments, from house appliances to cinema cameras, so closing a division could be easier for them, especially considering that they don’t carry the same long history in the camera business as Olympus does.

I don’t want to imply that Panasonic will shut down anything, plus even if I wanted to, I would have no proof whatsoever, but today’s stakes remain: the market is shrinking, smartphones are getting more popular, pandemics do not help, and financial losses can’t be ignored forever. The reasons Olympus gave us for divesting could be anybody else’s reasons. I guess only time will tell.

Conclusion: all we can do for now is wait

I wanted to share my two cents here because I felt it was important to talk about this. Olympus has made a vital contribution to the rise of mirrorless cameras, and was one of the brands that ignited our passion for photography and camera reviews. In fact, the OM-D E-M5 was the first model we tested when we started out.

As I said earlier, I’m no expert when it comes to corporate business and I’m not a fortune teller either so I can’t predict the future. I hope that the Olympus brand will survive, but if we want to be realistic, we should also prepare for something more drastic.

History shows that change like this happen, often because of the evolution of the market – just think about what the transition from film to digital meant for many companies. All we can do is wait and hope for the best!

In the meantime, let us know what you think in the comments below!

Article Updates

Sony – JIP – Vaio

Among the negative thoughts concerning JIP, there is the Vaio example. Vaio is a Sony brand for a series of high quality Windows computers. Sony was shipping them worldwide before JIP bought the brand and resized the division for the Japanese market, outsourcing production to China to reduce the costs.

Many people fear that Olympus will meet the same fate. The question is: will it? It’s difficult to say without speculating for now.

That said, if you look at the memorandum of understanding between Sony and JIP signed in 2014, you can read that Sony and JIP had agreed from the start to shrink the Vaio product line-up for the Japanese market. Here is a quote from the statement:

Following reevaluation of the product lineup, the new company will initially concentrate on sales of consumer and corporate PCs in the Japanese market and seek to optimize its sales channels and scale of operations, while evaluating possible further geographic expansion.

The Olympus statement doesn’t mention anything like this. In fact it says that research and development, as well as support, will continue globally, as explained further above.

Updated Lens Roadmap and interviews

A few days later, Olympus announced some additional information:

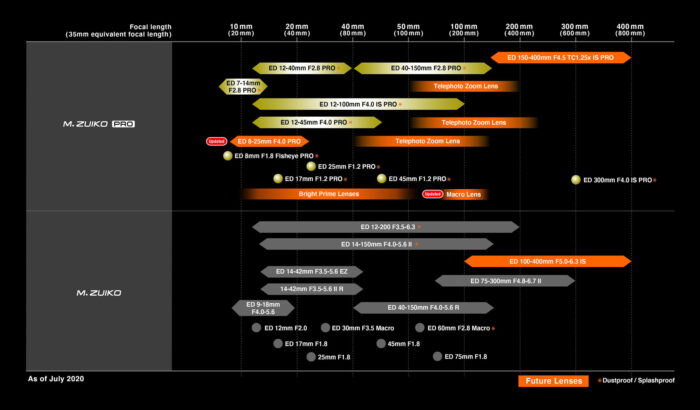

- an updated lens roadmap

- OM-D Webcam Beta software to use your camera as a webcam (Windows only for now)

- the upcoming 150-400mm f/4.5 Pro lens should be available in winter 20/21

- a firmware update for the E-M1X that will enable bird subject detection (ETA winter as well).

Mark Thackara, Marketing Brand Manager for Olympus UK, was interviewed by Amateur Photographer. Here is a quote from him:

Don’t panic. As far as we are concerned it is business as usual. Businesses change hands and flourish, so there no reason this won’t be the case here. I have been through all sorts of ups and downs in my 35 years with Olympus. Our basic technology and core proposition are still very good.

Another interview at DPreview with Setsuya Kataoka, VP of Global Strategy, Olympus Imaging Division (found via 43rumors):

First, I would like to stress that the sale of the Imaging Division does not mean that we will withdraw from the imaging business. We will continue to offer unique and exciting products. Of course there will be some changes in management, and transformation of the organizational structure after the transfer, but these changes are to stabilize the business and strengthen the organization and our operations. We think the transfer of the Imaging Division will have a positive effect on our imaging business.

Second Statement

On July 16th Olympus released a second statement that you can read here. Here are some quotes:

The New Imaging Company would assume and build growth strategy around the renowned Zuiko, OM and other brands, featuring optical and lens technologies developed and cultivated by Olympus over decades. Assuming the R&D and manufacturing frameworks, the New Imaging Company would commit to deliver high quality and reliability products and services to the Olympus customers around the globe.

New product development for each product category within the Imaging business will continue and we will keep you up to date as we make progress.

NewCo is now labelled New Imaging Company (temporary name) and the statement confirms that JIP will manage, operate and advise the Imaging Business funds transferred from Olympus.

In a post, 43rumors share additional information including that future products could use the OM and Pen names only, dropping the Olympus name.

Definitive agreement signed

On September 30th, Olympus and JIP have signed a definitive agreement for the divestiture of the imaging business.

Olympus will split the company and create a new imaging company called OM Digital Solutions Corporation that will take over the Imaging business. Then 95% of its shares will be transferred to OJ Holdings, Ltd. a company established by JIP. The process should be completed by January 2021.

You can read the full statement here.

Transfer completed

The transfer has been completed on January 1st, 2021. The newly formed OM Digital Solutions Corporation (a subsidiary of Japan Industrial Partners) takes over the imaging business from Olympus. You can read the full statement here.

DPreview also shared additional information, most notably that OM Digital Solutions has licensed the use of the Olympus name and therefor will be able to use it for future products.